Investor behavior is assessed by whether they are motivated by greed or fear. How does the index aid in decision making?

The Bitcoin Fear and Greed Index is a tool primarily used to evaluate Bitcoin, as it is the most valuable cryptocurrency and has a significant influence on the overall market’s price trends. This article intends to illustrate the mechanics and importance of this index by concentrating on the Bitcoin Fear and Greed Index.

The Bitcoin Fear and Greed Index is based on a combination of 5 different data sources.

From one day to the next, each piece of data is evaluated the same way as the previous day to enable a significant change in sentiment to be visualized between different periods.

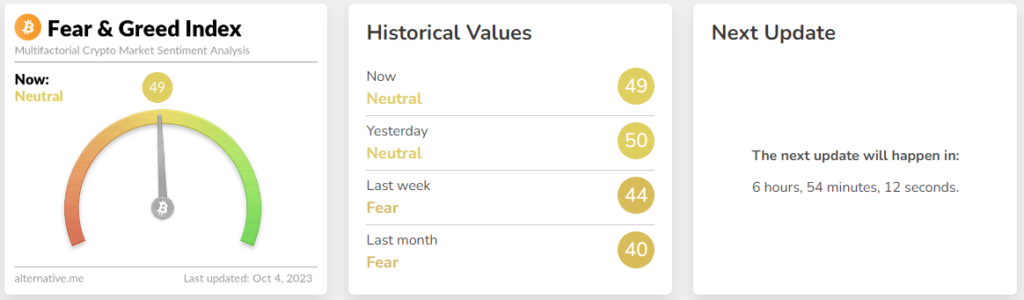

The index measures feelings of fear and greed in the market from 0 to 100.

- From 0 to 25, the index shows “Extreme Fear”;

- From 25 to 45, the index shows “Fear”;

- From 45 to 55, the index will show “Neutral”;

- From 55 to 75, the index shows Greed;

- From 75 to 100, the index will show “Extreme Greed”.

Here’s how the Bitcoin Fear and Greed Index is calculated.

25% of the index is based on Bitcoin (BTC) volatility

The index compares Bitcoin’s current volatility and price declines with averages over the last 30 and 90 days. This differentiates between a period of sudden volatility and one of high volatility following another.

An unusual increase in volatility accompanied by a fall in the price of Bitcoin will result in a fall in the index.

Conversely, an unusual increase in volatility accompanied by a rise in the price of Bitcoin will result in a rise in the index.

25% of the index is based on market trend and volume

The Bitcoin Fear and Greed Index compares current volumes and market trend with the averages of the last 30 and 90 days.

A bear market with a sudden increase in outgoing volumes will result in a drop in the index.

Conversely, a bull market with a sudden increase in incoming volumes will result in a rise in the index.

15% of the index measures investor enthusiasm on social networks

The index collects and analyzes mentions of Bitcoin (BTC) on various social media, assessing the frequency and scale of interactions over time.

An unusual increase in Bitcoin mentions will result in a rise in the index.

10% index measures fluctuations in Bitcoin dominance

An increase in Bitcoin dominance will be interpreted by the index as a sign of fear, interpreting it as a reduction in investments in more speculative and riskier altcoins.

The index assumes that an increase in its Bitcoin dominance shows a rush of capital into the market’s leading cryptocurrency as a hedge against volatility.

Conversely, a decrease in Bitcoin dominance indicates that investors are becoming greedier, investing in riskier cryptocurrencies and hoping for bigger gains.

10% of the index measures Google searches

The index uses Google Trends data on various Bitcoin-related queries. It analyzes the most popular searches currently recommended, as well as changes in search volumes.

For example, a significant increase in searches on “Bitcoin price manipulation” is considered a sign of fear in the market and will result in a drop in the index.

Conversely, a significant increase in searches on how to “buy Bitcoin” is seen as a sign of greed in the market, and will result in a rise in the index.

15% of the index takes into account investor responses to various surveys

At the time of writing, this component is currently on hiatus, but it involves conducting weekly surveys on Bitcoin in partnership with Strawpoll. These polls gather the opinions of a group of investors, typically consisting of 2,000 to 3,000 participants per poll.

Investors’ opinions are then taken into account in the calculation of the Bitcoin Fear and Greed Index. If the investors surveyed are confident, the index will approach 100. Conversely, if they are too cautious, the index will approach 0.

With all this data, the Fear and Greed Index creates a comprehensive measure of Bitcoin market sentiment. This article only mentions Bitcoin’s Fear and Greed index, but similar indices exist for many other assets.

How to interpret the Crypto Fear and Greed Index?

It’s crucial to remember that the sentiment index is only an indicator. It can be easy to misinterpret it.

In fact, when the index reads “Extreme Fear”, it doesn’t automatically mean that the market has bottomed.

Similarly, when the index reads “Extreme Greed”, it doesn’t automatically mean that the market has peaked.

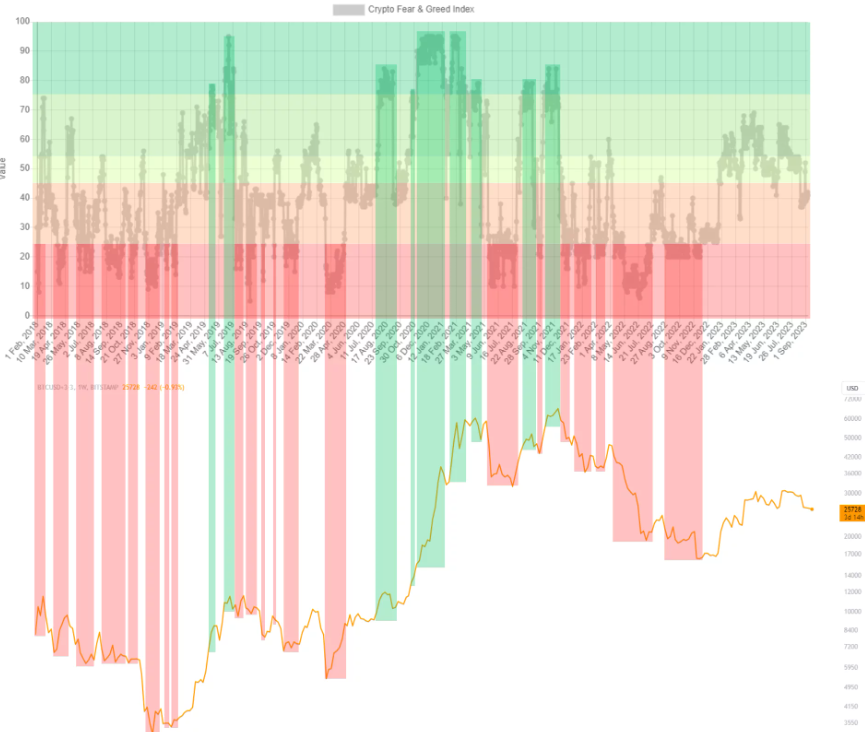

As illustrated by the chart above, which shows periods of “Extreme Fear” in red and periods of “Extreme Greed” in green on the Bitcoin (BTC) market, they do not correspond precisely to the market’s lowest and highest points.

The Crypto Fear and Greed Index is a useful tool for understanding market sentiment, but it should never be the only factor influencing your buying or selling decisions.

The best approach to using this index is to combine it with a method that looks for confluences of different signals based on chart analysis and several indicators.

If you’d like to deepen your understanding of market analysis and price movements, consider joining our Cryptoast Research community.

This community offers you the opportunity to learn more about the fundamentals of crypto-currencies, improve your reading of price movements thanks to Vincent Ganne’s analyses, and make more effective use of numerous indicators.